Over 30 Million Users Benefit From Ant International’s Bettr Credit Tech Solutions

Powering the Next Wave of MSME Growth with Digital Platforms in Emerging Markets· There was a threefold year-on-year increase i..

News

Lifestyle

Industries

Industries

Trackd music app seeks further investment for tech development and US marketing drive

All Posts

Powering the Next Wave of MSME Growth with Digital Platforms in Emerging Markets· There was a threefold year-on-year increase i..

News

● Questions to be addressed include how Islamic economies can bridge growth gaps in Western markets ● ..

News

· AI-as-a-Service applications will make AI virtual CFO and COO for SMEs· Public-private collaboration in regulato..

News

· The EPOS360 App integrates POS system, payments, banking, lending, and growth support into one platform to help MSM..

News

· Alipay+ GlassPay, Ant International’s smart glasses-embedded payment solution, will add iris authentication to its security verificatio..

News

John Lee, Chief Executive of Hong Kong SAR visited the booths of Ant International and Ant Digital Technologies during the 10th annual Hong Kong Finte..

News

Despite years of investment in digital transformation, finance functions remain heavily reliant on manual processes that slow down decision-making a..

Business

Platico SA has announced progress on its OPICO Digital Platinum Coin project, which is intended to combine digital token features with links to plat..

News

With over a quarter of the world’s population Muslim, alongside increasing financial literacy and the rise of online trading, many brokers are adverti..

Finance

- The now-independent company combines techfin and sustainability work&nbs..

Business

Firm set to complete further US acquisition by end of 2025 London, UK, June, 2025 - Paynt, a global payment technology leader, has strategic..

Business

Clearhaus celebrates 10 years as an active acquirer and takes the next step toward Unified Commerce. Clearhaus, one of Denmark’s leading ac..

Business

London, UK – 19 April 2025 Author and transformation advocate Donn C. McCalla unveils Phenomenal Women: How I Lost Myself and Found the Fire to Rise ..

News

But companies are struggling to monetise AI – and CFOs are sounding the alarm.New data has revealed that 71% of&nbs..

Business

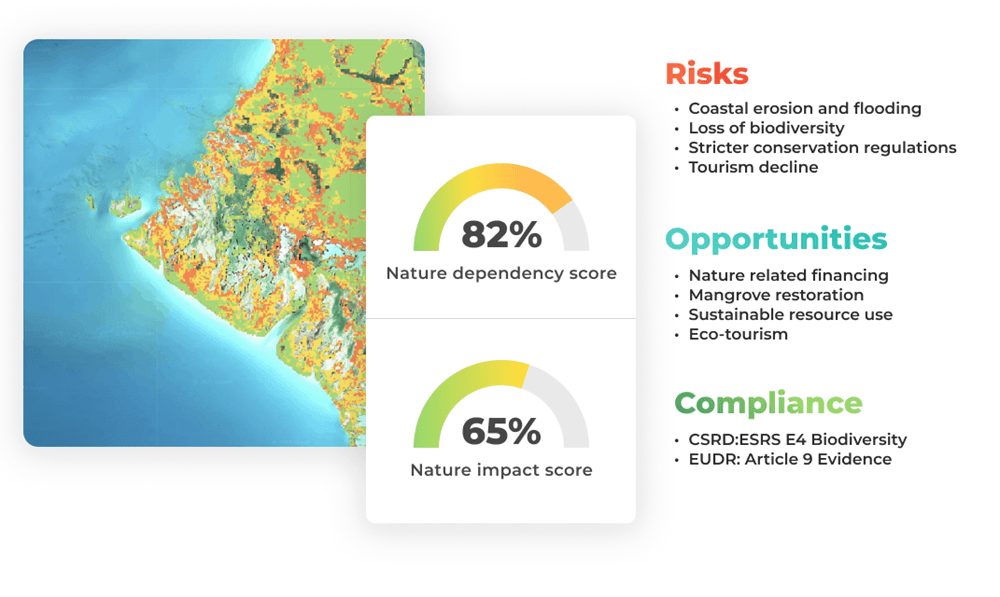

By Mike Mason, Chief Operating Officer at Earth BloxIn the past, sustainability used to be a passion project. Something bolted onto the business,..

Business

Collaborating with AliExpress and local partners to provide SME financing, support local economySão Paulo, March 17, 2025 – Bettr, a leading AI-driven..

BOSTON, MA - February 20, 2025 - Starburst, the data platform for apps and AI, announced a record FY25 close, driven by strong demand f..

Technology

Jiang-Ming Yang will be responsible for driving investments in and synergy between product and technology teamsA new CIO Organisation will be created ..

News

The Caribbean has long been synonymous with pristine beaches, vibrant culture, and unparalleled hospitality. However, a new narrative is emerging. Ang..

Technology

· Market proximity of Strides Pharma International AG, based in Zug, Switzerland, opens the way for rapid ..

Business

Numbers show Alipay+ expands a vibrant wallet-based payment and digitalisation space that further strengthens WorldFirst and Antom, t..

Excellence

Thanks to Starburst’s solution, HSBC has accelerated its access to information with queries up to 20 times faster, reducing anal..

Technology

Swiss International University LLC acquires four leading academies in Switzerland, Kyrgyzstan and the UAE from a well-established lear..

Business

International demand for education still continues to grow unabated, with several millions of students going to other countries to stu..

Finance

Zurich, November 21, 2024 Squirro, a leading enterprise GenAI platform provider, is excited to announce that it has been listed among ..

Technology

Survey results highlight that cybersecurity automation is now an important part of cybersecurity professionals’ defensive strategy – b..

Technology

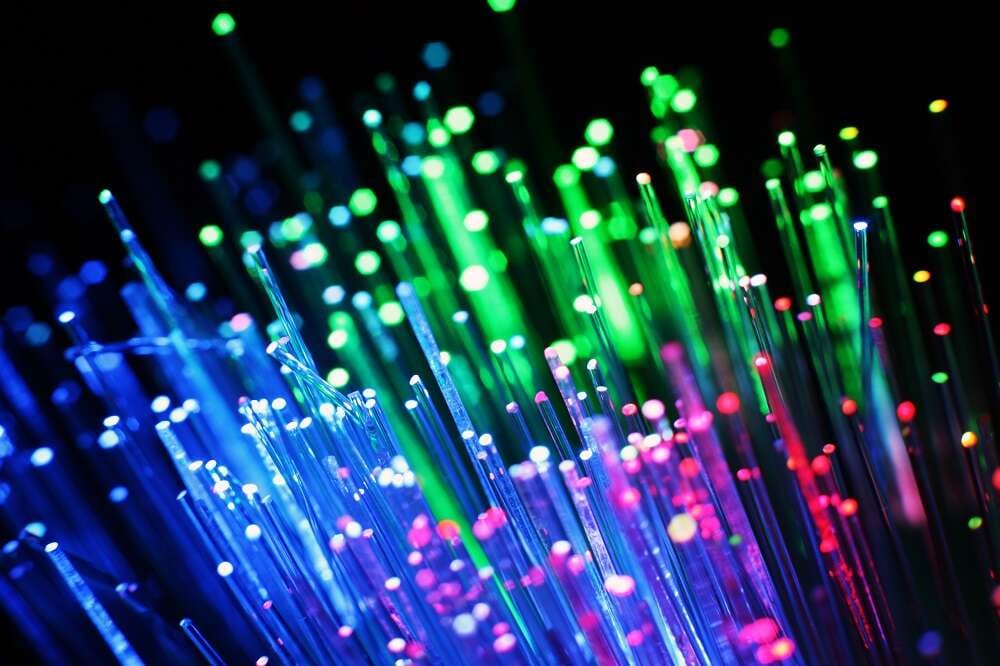

The Global Fiber Optic Patch Cord Market is projected to grow at a CAGR of 5.5% from 2024 to 2030, according to a new report published..

Research Reports

The Global Ultrasonic Imaging Camera Market is projected to grow at a CAGR of 15.2% from 2024 to 2030, according to a new report publi..

Research Reports

The Global Adaptive Learning Software Market is projected to grow at a CAGR of 18.14% from 2024 to 2030, according to a new report pub..

Research Reports

The Global Turbocompressor Market is projected to grow at a CAGR of 5.23% from 2024 to 2030, according to a new report published by Ve..

Research Reports

The Global Platelet Agitator Market is projected to grow at a CAGR of 4.88% from 2024 to 2030, according to a new report published by ..

Research Reports

The Global Mining Software Market is projected to grow at a CAGR of 8.1% from 2024 to 2030, according to a new report published by Ver..

Research Reports

CFE Finance Group, an investment banking boutique, has acquired 100% of TechStar, a pioneering company in industrial metaverse technol..

Technology

– Durham Centre for Islamic Economics and Finance and AlBaraka Forum sign historic memorandum of understanding to further the de..

Finance

In times of economic uncertainty, rising inflation, and financial instability, entrepreneurs need to embrace strategies that promote r..

Business

With over 45% of adults in the UK struggling to manage their domestic bills and credit commitments, millions are left without access t..

Finance

Compare the commonly used trading accounts in forex. Typically, all forex brokers require traders to set up a new account before buyin..

Finance